RBI Governors have been at the forefront of steering India’s economy through various economic phases, crises, and reforms. Their contributions have been crucial in shaping India’s financial landscape and ensuring stability amidst global economic dynamics. As India continues its journey towards economic growth and development, the role of the RBI Governor remains pivotal in safeguarding financial stability and promoting sustainable economic progress.

RBI Governors: Custodians of India’s Financial Stability

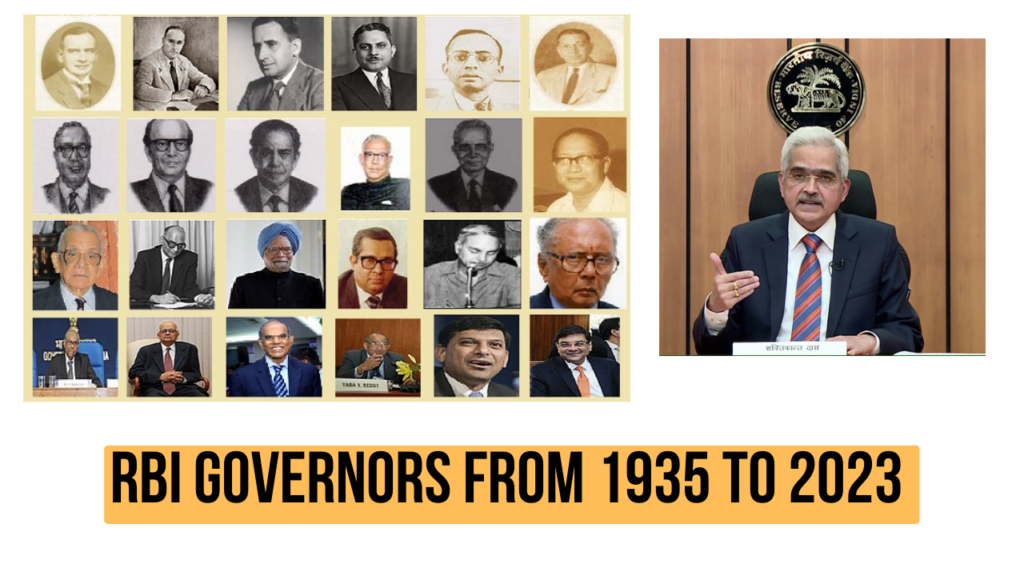

The Governor of the Reserve Bank of India (RBI) holds the highest office in India’s central banking system, overseeing crucial monetary policies and financial regulations. Since the establishment of the RBI in 1935, 25 distinguished individuals have served as Governors, each leaving a lasting imprint on India’s economic landscape.

Evolution of RBI Governors

The role of RBI Governor is pivotal, shaping the country’s economic policies and financial strategies. From Sir Osborne Smith, the first Governor, to the incumbent Shri Shaktikanta Das, each Governor has navigated India through various economic challenges and transformations.

List of RBI Governors (1935-2024)

Here is a comprehensive list of RBI Governors who have guided India’s central bank:

- Sir Osborne Smith (1935-1937) – The inaugural Governor of the RBI, overseeing its establishment and initial operations.

- Sir James Brad Taylor (1937-1943) – Guided the RBI through the tumultuous years of World War II.

- Sir Chintaman Dwarkanath Deshmukh (1943-1949) – Steered India’s monetary policies during the critical post-independence period.

- Shri Benegal Rama Rau (1949-1957) – Managed the RBI during India’s early economic planning phases.

- Shri K.G. Ambegaonkar (1957) – Brief tenure focused on stabilizing India’s financial policies.

- Shri H.V.R. Iyengar (1957-1962) – Oversaw economic policies during a period of significant industrial growth.

- Shri P.C. Bhattacharya (1962-1967) – Managed monetary policies amidst the Indo-Pak war and economic challenges.

- Shri L.K. Jha (1967-1970) – Initiated reforms to strengthen India’s banking sector.

- Shri B.N. Adarkar (1970) – Short tenure marked by initiatives to stabilize the economy.

- Shri S. Jagannathan (1970-1975) – Focused on economic stability amidst global economic shifts.

- Shri N.C. Sen Gupta (1975) – Steered the RBI during a critical phase of economic reforms.

- Shri K.R. Puri (1975-1977) – Managed economic policies during a period of economic challenges.

- Shri M. Narasimham (1977) – Contributed to financial reforms and stabilization efforts.

- Dr. I.G. Patel (1977-1982) – Instituted reforms to modernize India’s banking sector.

- Dr. Manmohan Singh (1982-1985) – Laid groundwork for economic liberalization policies.

- Mr. Amitabh Ghosh (1985) – Oversaw transitional monetary policies.

- Shri R.N. Malhotra (1985-1990) – Pioneered financial sector reforms and economic stabilization.

- Shri S. Venkitaramanan (1990-1992) – Strengthened India’s monetary policies amidst economic challenges.

- Dr. C. Rangarajan (1992-1997) – Championed economic reforms and financial sector liberalization.

- Dr. Bimal Jalan (1997-2003) – Contributed to strengthening India’s monetary policies and financial stability.

- Dr. Y.V. Reddy (2003-2008) – Navigated India through global financial crises and economic reforms.

- Dr. D. Subbarao (2008-2013) – Managed monetary policies during global economic uncertainties.

- Dr. Raghuram Rajan (2013-2016) – Implemented policies to stabilize India’s currency and economy.

- Dr. Urjit Patel (2016-2018) – Led efforts to reform India’s banking sector and financial regulations.

- Shri Shaktikanta Das (2018-present) – Current Governor, focusing on economic recovery and stability post-pandemic.

Shaktikanta Das: Current RBI Governor

Shri Shaktikanta Das, the 25th Governor of RBI, assumed office on December 11, 2018. A former Finance Secretary and member of the Finance Commission, Das has been instrumental in navigating India’s economy through challenging times. Recently, his tenure was extended by three years, emphasizing his role in shaping India’s economic recovery and financial stability.

Appointment and Responsibilities of RBI Governor

The Government of India appoints the RBI Governor for a fixed term of five years, overseeing crucial aspects of India’s monetary policies and financial regulations. The Governor plays a pivotal role in:

- Monetary Stability: Formulating policies to stabilize prices and ensure economic growth.

- Banking Sector Oversight: Regulating and supervising banks to maintain financial stability.

- Foreign Exchange Management: Managing India’s foreign exchange reserves and policies.

- Financial Sector Development: Promoting development and regulation of financial markets.

- Currency Issuance: Monitoring and managing currency circulation and stability.

For more detailed information on RBI Governors and their roles, visit the official Reserve Bank of India website.

Additional Resources

Explore more about India’s economic leadership and governance:

- List of Finance Ministers of India from 1947 to 2024.

- Cabinet Ministers of India 2024 and their portfolios.

This comprehensive overview underscores the critical role of RBI Governors in India’s economic governance and policy formulation. Each Governor’s tenure has left a distinct legacy, shaping the course of India’s economic history.